Greater Fees: SDIRAs usually include higher administrative costs in comparison to other IRAs, as particular elements of the executive course of action can't be automated.

Feel your friend could possibly be starting up another Facebook or Uber? Using an SDIRA, you can invest in will cause that you suspect in; and possibly get pleasure from bigger returns.

No, you cannot invest in your very own small business with a self-directed IRA. The IRS prohibits any transactions between your IRA as well as your very own small business since you, as being the operator, are thought of a disqualified individual.

The tax positive aspects are what make SDIRAs desirable For a lot of. An SDIRA can be both of those classic or Roth - the account sort you end up picking will rely mainly with your investment and tax strategy. Test with all your financial advisor or tax advisor in case you’re Not sure which happens to be very best for you personally.

In advance of opening an SDIRA, it’s important to weigh the opportunity pros and cons determined by your distinct money aims and possibility tolerance.

Quite a few investors are amazed to find out that applying retirement money to speculate in alternative assets is possible due to the fact 1974. Nevertheless, most brokerage firms and financial institutions deal with giving publicly traded securities, like shares and bonds, since they absence the infrastructure and experience to manage privately held assets, such as real estate or non-public equity.

Better investment alternatives signifies you are able to diversify your portfolio further than stocks, bonds, and mutual money and hedge your portfolio from marketplace fluctuations and volatility.

A self-directed IRA can be an very potent investment car, but it surely’s not for everybody. Since the stating goes: with fantastic energy will come good accountability; and using an SDIRA, that couldn’t be a lot more accurate. Continue reading to discover why an SDIRA may well, or won't, be in your case.

Opening an SDIRA can provide you with use of investments Ordinarily unavailable through a bank or brokerage company. In this article’s how to start:

Have the liberty to invest in Pretty much any kind of asset with a possibility profile that fits your investment system; like assets which have the likely for a higher fee of return.

This consists of being familiar with IRS laws, managing investments, and steering clear of prohibited transactions that can disqualify your IRA. An absence of knowledge could result in pricey blunders.

And because some SDIRAs such as self-directed common IRAs are subject matter to necessary minimum distributions (RMDs), you’ll should prepare in advance in order that you may have adequate liquidity to fulfill The principles established from the IRS.

Property is one of the most well-liked solutions among SDIRA holders. That’s because you are able to invest in any sort of real-estate using a self-directed IRA.

As opposed to shares and bonds, alternative assets in many cases are harder to promote or can have rigid contracts and schedules.

Ease of Use and Engineering: A user-helpful System with on the web tools to track your investments, post documents, and deal with your account is essential.

Building by far the most of tax-advantaged accounts try this web-site helps you to maintain more of the money that you just make investments and gain. Based on no matter if you choose a standard self-directed IRA or maybe a self-directed Roth IRA, you have the possible for tax-cost-free or tax-deferred development, provided certain ailments are satisfied.

Due Diligence: It's termed "self-directed" for the cause. Having an SDIRA, you are solely answerable for extensively looking into and vetting investments.

Sure, housing is one of our purchasers’ most favored investments, often termed a housing IRA. Consumers have the choice to take a position in all the things from rental Qualities, industrial real-estate, undeveloped land, home loan notes plus much more.

IRAs held at banking companies and brokerage firms provide confined investment selections for their customers mainly because they would not have the skills or infrastructure to administer alternative assets.

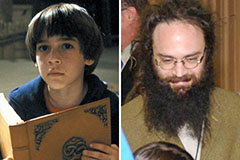

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!